-

Table of Contents – Stakeholder Communication

- Potential Buyers

- Assessing Market Conditions for Exit Timing

- Diversifying Exit Options: Mergers, Acquisitions, and IPOs

- Valuation Strategies in a Downturn

- Communicating with Stakeholders During Economic Uncertainty

- Leveraging Operational Improvements for Better Exit Outcomes

- Identifying Potential Buyers in a Challenging Market

- Case Studies: Successful Exits During Economic Downturns

- Q&A

- Conclusion

This article on Portfolio company value optimization during economic downturns also touches on related topics like Market Conditions, Stakeholder Communication, Operational Improvements, Potential Buyers.

“Navigating Uncertainty: Tailored Exit Strategies for Resilient Portfolio Companies.” Market Conditions is a foundational topic here. Operational Improvements is equally relevant.

In times of economic downturns, portfolio companies face unique challenges that necessitate a reevaluation of their exit strategies. As market conditions shift, the traditional approaches to exiting investments may no longer be viable or optimal. Adapting exit strategies becomes crucial for maximizing value and ensuring the sustainability of these companies. This involves a thorough analysis of market trends, investor sentiment, and potential acquirers, as well as a focus on operational efficiencies and strategic pivots. By proactively adjusting their exit plans, investors can better navigate the complexities of a recessionary environment, ultimately positioning their portfolio companies for successful transitions, whether through mergers and acquisitions, public offerings, or alternative liquidity events.

Assessing Market Conditions for Exit Timing

In the ever-evolving landscape of investment, the timing of an exit strategy can significantly influence the success of portfolio companies, particularly during economic downturns. As market conditions fluctuate, investors must remain vigilant and adaptable, assessing various factors that can impact the optimal timing for exiting their investments. Understanding these market conditions is not merely a matter of timing; it is about recognizing the broader economic environment and its implications for both the portfolio company and the investor.

To begin with, it is essential to analyze macroeconomic indicators that signal the health of the economy. Factors such as GDP growth rates, unemployment levels, and consumer confidence can provide valuable insights into market conditions. For instance, a declining GDP or rising unemployment may indicate a recession, prompting investors to reconsider their exit strategies. In such scenarios, it becomes crucial to evaluate whether the portfolio company can withstand economic pressures or if it is better positioned for a strategic exit. By closely monitoring these indicators, investors can make informed decisions that align with the prevailing economic climate.

Moreover, industry-specific trends also play a pivotal role in determining exit timing. Different sectors respond uniquely to economic fluctuations, and understanding these dynamics can help investors identify the right moment to exit. For example, during an economic downturn, consumer discretionary sectors may experience a decline in demand, while essential goods and services may remain stable or even thrive. By assessing the resilience of the portfolio company within its industry, investors can gauge whether it is prudent to hold on for potential recovery or to capitalize on current valuations before further declines occur.

In addition to macroeconomic and industry-specific factors, investor sentiment and market liquidity are critical components to consider. During economic downturns, market sentiment can shift dramatically, affecting the willingness of potential buyers to engage in transactions. A cautious market may lead to lower valuations, making it essential for investors to be strategic about their exit timing. Conversely, if investor sentiment begins to improve, even slightly, it may present an opportunity to exit at a more favorable valuation. Therefore, staying attuned to market sentiment and liquidity conditions can empower investors to make timely decisions that maximize returns.

Furthermore, it is important to recognize the role of operational performance in exit timing. A portfolio company that demonstrates strong fundamentals, such as robust cash flow and a solid customer base, may be better positioned to weather economic storms. Investors should continuously assess the operational health of their portfolio companies, as this can influence both the timing and method of exit. If a company is performing well despite external challenges, it may be wise to consider an exit strategy that capitalizes on its strengths, even in a downturn.

Ultimately, adapting exit strategies for portfolio companies during economic downturns requires a multifaceted approach. By assessing market conditions, including macroeconomic indicators, industry trends, investor sentiment, and operational performance, investors can navigate the complexities of exit timing with confidence. This adaptability not only enhances the potential for successful exits but also inspires a proactive mindset that can lead to greater resilience in the face of economic challenges. In a world where uncertainty is a constant, the ability to pivot and respond to changing conditions is a hallmark of successful investing, ensuring that portfolio companies can thrive even in the most challenging environments.

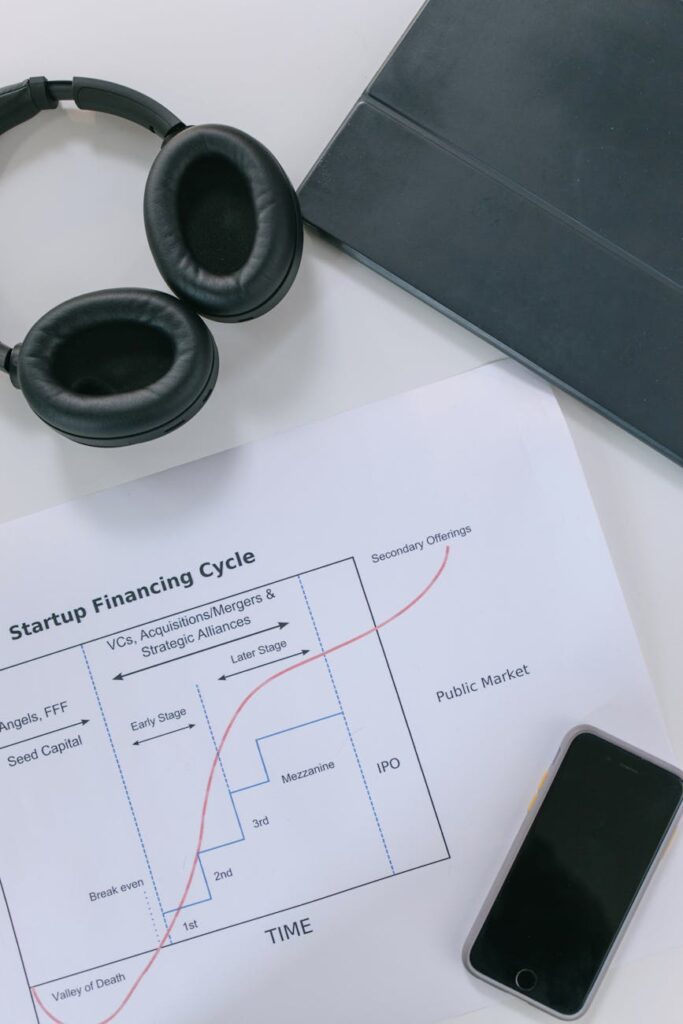

Diversifying Exit Options: Mergers, Acquisitions, and IPOs

In the ever-evolving landscape of business, economic downturns present unique challenges and opportunities for portfolio companies. As market conditions shift, the need for adaptive exit strategies becomes paramount. Diversifying exit options, particularly through mergers, acquisitions, and initial public offerings (IPOs), can provide a robust framework for navigating these turbulent times. By embracing a multifaceted approach, companies can not only safeguard their interests but also position themselves for future growth.

Mergers and acquisitions often emerge as viable exit strategies during economic downturns. In times of uncertainty, companies may find themselves seeking synergies that can enhance operational efficiency and market reach. For instance, a smaller firm may consider merging with a larger entity to leverage its resources and expertise. This collaboration can lead to cost savings, improved product offerings, and a stronger competitive position. Moreover, the combined strengths of two organizations can create a more resilient entity capable of weathering economic storms. As such, the potential for mergers and acquisitions becomes an attractive option for portfolio companies looking to adapt their exit strategies.

Transitioning to the acquisition side, it is essential to recognize that downturns can also create opportunities for strategic buyers. Larger companies often seek to acquire smaller firms at discounted valuations, allowing them to expand their market share and diversify their offerings. For portfolio companies, this can mean a timely exit that not only maximizes value but also ensures that their legacy continues under a new umbrella. By actively exploring acquisition opportunities, companies can position themselves as attractive targets, thereby enhancing their exit potential.

In addition to mergers and acquisitions, initial public offerings (IPOs) can serve as a powerful exit strategy, even in challenging economic climates. While the IPO market may experience fluctuations, companies that have demonstrated resilience and adaptability can still attract investor interest. A well-timed IPO can provide a significant influx of capital, enabling portfolio companies to invest in growth initiatives and innovation. Furthermore, going public can enhance a company’s visibility and credibility, making it an appealing option for potential acquirers in the future. By carefully assessing market conditions and aligning their growth strategies with investor expectations, companies can successfully navigate the IPO landscape, even during downturns.

As companies consider diversifying their exit options, it is crucial to remain agile and responsive to changing market dynamics. This adaptability not only involves evaluating the current economic climate but also understanding the long-term implications of each exit strategy. Engaging with financial advisors and industry experts can provide valuable insights into the best course of action, ensuring that portfolio companies are well-prepared to seize opportunities as they arise.

Ultimately, the key to successfully adapting exit strategies during economic downturns lies in a proactive mindset. By diversifying exit options through mergers, acquisitions, and IPOs, portfolio companies can create a safety net that mitigates risks while maximizing potential rewards. Embracing this multifaceted approach not only empowers companies to navigate challenging times but also inspires confidence among stakeholders. As businesses continue to evolve, those that remain open to innovative exit strategies will not only survive but thrive, emerging stronger and more resilient in the face of adversity. In this way, economic downturns can serve as catalysts for transformation, driving companies toward new horizons of success.

Valuation Strategies in a Downturn

In times of economic downturn, the valuation of portfolio companies becomes a critical focus for investors and stakeholders alike. As market conditions shift, traditional valuation methods may no longer apply, necessitating a reevaluation of strategies to accurately assess the worth of these companies. Understanding how to adapt valuation strategies during such challenging periods can not only safeguard investments but also position companies for future growth when the economy rebounds.

One of the first steps in adapting valuation strategies is to embrace a more conservative approach. During economic downturns, revenue projections often become less reliable due to fluctuating consumer demand and market instability. Therefore, it is essential to adjust financial forecasts to reflect a more cautious outlook. This may involve revisiting historical performance data and considering the impact of external factors, such as changes in consumer behavior or supply chain disruptions. By grounding valuations in realistic expectations, investors can avoid overestimating a company’s worth and make more informed decisions.

Moreover, it is crucial to incorporate a wider range of valuation methodologies. While discounted cash flow (DCF) analysis is a common approach, its effectiveness can diminish in uncertain economic climates. In such cases, employing relative valuation techniques, such as comparing similar companies within the same industry, can provide valuable insights. This method allows investors to gauge a company’s performance against its peers, offering a more nuanced understanding of its market position. Additionally, utilizing asset-based valuations can be beneficial, particularly for companies with significant tangible assets. By focusing on the intrinsic value of these assets, investors can establish a baseline valuation that may be more resilient during downturns.

As the economic landscape evolves, it is also important to consider the qualitative aspects of a company’s value. Factors such as management quality, brand strength, and customer loyalty can significantly influence a company’s resilience in tough times. By assessing these qualitative elements, investors can gain a deeper understanding of a company’s potential to weather economic storms. This holistic approach to valuation not only enhances accuracy but also fosters a more comprehensive view of the company’s long-term prospects.

Furthermore, communication plays a vital role in the valuation process during downturns. Engaging in open dialogue with portfolio companies can yield valuable insights into their operational challenges and strategic responses. By fostering transparency, investors can better understand the factors influencing a company’s performance and adjust their valuation models accordingly. This collaborative approach not only strengthens relationships but also empowers companies to navigate difficult times with greater confidence.

In addition to these strategies, it is essential to remain agile and responsive to changing market conditions. Economic downturns are often characterized by rapid shifts, and the ability to adapt quickly can make a significant difference in valuation outcomes. Regularly revisiting and updating valuation models ensures that they remain relevant and reflective of current realities. This proactive stance not only enhances decision-making but also positions investors to capitalize on emerging opportunities as the market begins to recover.

Ultimately, adapting valuation strategies during economic downturns is not merely about protecting investments; it is about fostering resilience and paving the way for future success. By embracing a comprehensive, flexible approach to valuation, investors can navigate the complexities of challenging economic environments while positioning their portfolio companies for growth. In doing so, they not only safeguard their investments but also contribute to the long-term sustainability of the businesses they support, inspiring confidence and innovation even in the face of adversity.

Communicating with Stakeholders During Economic Uncertainty

In times of economic uncertainty, the importance of effective communication with stakeholders cannot be overstated. As portfolio companies navigate the challenges posed by downturns, the ability to convey clear, transparent, and reassuring messages becomes paramount. Stakeholders, including investors, employees, customers, and suppliers, are often anxious about the future, and their concerns can be alleviated through thoughtful communication strategies. By fostering an environment of trust and openness, companies can not only maintain relationships but also inspire confidence in their ability to weather the storm.

To begin with, it is essential to establish a consistent communication framework. This involves regular updates that provide stakeholders with insights into the company’s performance, strategic adjustments, and market conditions. By proactively sharing information, companies can mitigate uncertainty and demonstrate their commitment to transparency. For instance, quarterly reports can be supplemented with special communications that address specific challenges posed by the economic climate. This approach not only keeps stakeholders informed but also reinforces the notion that the company is actively managing its response to the downturn.

Moreover, it is crucial to tailor messages to different stakeholder groups. Investors may be primarily concerned with financial metrics and return on investment, while employees might be more focused on job security and workplace morale. By understanding the unique perspectives of each group, companies can craft messages that resonate with their specific concerns. For example, while investors may appreciate detailed financial forecasts and risk assessments, employees might benefit from messages that emphasize the company’s commitment to maintaining a supportive work environment. This targeted communication fosters a sense of inclusion and ensures that all stakeholders feel valued and heard.

In addition to addressing concerns, it is equally important to communicate a vision for the future. During economic downturns, stakeholders often seek reassurance that the company has a plan for recovery and growth. By articulating a clear strategy that outlines how the company intends to navigate the challenges ahead, leaders can inspire confidence and motivate stakeholders to remain engaged. This vision should not only focus on short-term survival but also highlight long-term opportunities that may arise from the current situation. For instance, companies might explore new markets, innovate product offerings, or enhance operational efficiencies as part of their recovery strategy. By framing the downturn as a catalyst for positive change, leaders can galvanize support and foster a sense of shared purpose among stakeholders.

Furthermore, fostering two-way communication is vital during these uncertain times. Encouraging feedback from stakeholders can provide valuable insights and help leaders make informed decisions. This can be achieved through surveys, town hall meetings, or informal discussions, allowing stakeholders to voice their concerns and suggestions. By actively listening and responding to feedback, companies can demonstrate their commitment to collaboration and adaptability. This not only strengthens relationships but also empowers stakeholders to feel like active participants in the company’s journey.

Ultimately, effective communication during economic uncertainty is about more than just sharing information; it is about building resilience and fostering a sense of community among stakeholders. By prioritizing transparency, tailoring messages, articulating a clear vision, and encouraging dialogue, companies can navigate the complexities of downturns with confidence. In doing so, they not only safeguard their relationships but also lay the groundwork for a stronger, more united future. As challenges arise, the power of communication can transform uncertainty into opportunity, inspiring stakeholders to rally around a shared vision of resilience and growth.

Leveraging Operational Improvements for Better Exit Outcomes

In the face of economic downturns, portfolio companies often find themselves navigating a landscape fraught with challenges. However, these difficult times can also present unique opportunities for operational improvements that can significantly enhance exit outcomes. By focusing on refining operations, companies can not only weather the storm but also emerge stronger and more attractive to potential buyers. This approach requires a strategic mindset, emphasizing the importance of agility and innovation in the face of adversity.

To begin with, operational improvements can take many forms, from streamlining processes to enhancing product offerings. During economic downturns, companies may find that their existing operations are not as efficient as they could be. This realization can serve as a catalyst for change, prompting leaders to critically assess workflows and identify areas for optimization. For instance, implementing lean management techniques can help eliminate waste and improve productivity, ultimately leading to cost savings that bolster the bottom line. By focusing on efficiency, companies can position themselves as more resilient and capable of generating sustainable profits, even in challenging economic climates.

Moreover, enhancing customer experience can be a powerful lever for operational improvement. In times of economic uncertainty, customers become more discerning, often seeking greater value for their investments. By prioritizing customer feedback and making necessary adjustments to products or services, portfolio companies can not only retain existing customers but also attract new ones. This customer-centric approach fosters loyalty and can lead to increased revenue, making the company more appealing to potential acquirers. As companies adapt to meet evolving customer needs, they simultaneously strengthen their market position, which can significantly enhance exit outcomes.

In addition to refining internal processes and focusing on customer experience, leveraging technology can play a pivotal role in driving operational improvements. The rapid advancement of digital tools offers companies the opportunity to automate tasks, analyze data more effectively, and enhance decision-making processes. By embracing technology, portfolio companies can not only improve efficiency but also gain valuable insights into market trends and consumer behavior. This data-driven approach enables companies to pivot quickly in response to changing conditions, ensuring they remain competitive even during economic downturns. As a result, potential buyers are more likely to view these companies as forward-thinking and adaptable, qualities that are highly sought after in the marketplace.

Furthermore, fostering a culture of continuous improvement within the organization can lead to sustained operational enhancements. Encouraging employees to contribute ideas and solutions not only empowers them but also cultivates an environment where innovation thrives. This collaborative spirit can lead to breakthroughs that drive efficiency and effectiveness across the organization. When potential buyers see a company that values its workforce and is committed to ongoing improvement, they are more likely to perceive it as a valuable investment opportunity.

Ultimately, adapting exit strategies for portfolio companies during economic downturns requires a proactive approach to operational improvements. By focusing on efficiency, enhancing customer experience, leveraging technology, and fostering a culture of continuous improvement, companies can position themselves for better exit outcomes. In doing so, they not only navigate the challenges of the present but also lay the groundwork for a brighter future. As the economic landscape continues to evolve, those who embrace these strategies will find themselves not just surviving but thriving, ready to seize opportunities that arise in the wake of adversity.

Identifying Potential Buyers in a Challenging Market

In the face of economic downturns, identifying potential buyers for portfolio companies can be a daunting task, yet it is a crucial step in ensuring a successful exit strategy. As market conditions shift and uncertainty looms, the landscape of potential buyers often changes, requiring a more nuanced approach to identifying those who may be interested in acquiring a business. To navigate this challenging environment, it is essential to adopt a proactive mindset and leverage innovative strategies that can uncover hidden opportunities.

First and foremost, understanding the motivations of potential buyers during an economic downturn is vital. While some companies may be hesitant to make acquisitions due to financial constraints, others may see this as an opportune moment to expand their market share or acquire undervalued assets. Therefore, it is important to conduct thorough market research to identify which sectors are still thriving and which companies are actively seeking growth despite the economic climate. By focusing on industries that are resilient or even flourishing during downturns, portfolio managers can pinpoint potential buyers who are more likely to engage in acquisition discussions.

Moreover, networking becomes an invaluable tool in this process. Engaging with industry contacts, attending virtual conferences, and participating in relevant forums can help uncover potential buyers who may not be immediately visible through traditional channels. Building relationships with investment bankers, brokers, and other intermediaries can also provide insights into which companies are looking to acquire and what their specific criteria are. By fostering these connections, portfolio managers can create a robust pipeline of potential buyers, even in a challenging market.

In addition to traditional buyers, it is essential to consider alternative acquisition structures that may appeal to potential buyers during economic downturns. For instance, earn-outs or contingent payments can make acquisitions more attractive to buyers who may be wary of committing significant capital upfront. By structuring deals that align the interests of both parties, portfolio managers can facilitate transactions that might otherwise seem unattainable in a tight market. This flexibility not only broadens the pool of potential buyers but also enhances the likelihood of closing a deal.

Furthermore, it is crucial to emphasize the unique value proposition of the portfolio company. In uncertain times, buyers are often more discerning, so clearly articulating the strengths and competitive advantages of the business is essential. This may involve highlighting the company’s adaptability, strong customer relationships, or innovative products that can withstand economic pressures. By presenting a compelling narrative that resonates with potential buyers, portfolio managers can increase interest and engagement, even in a challenging environment.

Lastly, patience and persistence are key virtues during this process. Economic downturns can lead to prolonged decision-making cycles, as buyers may take longer to assess their options and weigh the risks involved. By maintaining open lines of communication and providing timely updates, portfolio managers can keep potential buyers engaged and informed, ultimately positioning themselves favorably when the time comes for a decision.

In conclusion, while identifying potential buyers in a challenging market may seem daunting, it is an opportunity for creativity and strategic thinking. By understanding buyer motivations, leveraging networks, considering alternative deal structures, emphasizing unique value propositions, and exercising patience, portfolio managers can successfully navigate the complexities of an economic downturn. Ultimately, these efforts can lead to fruitful exits that not only benefit the portfolio companies but also inspire confidence in the resilience of the market as a whole.

Case Studies: Successful Exits During Economic Downturns

In the realm of venture capital and private equity, the ability to adapt exit strategies during economic downturns can significantly influence the success of portfolio companies. While challenging, these periods can also present unique opportunities for innovative thinking and strategic pivots. Several case studies illustrate how companies have navigated turbulent times, ultimately achieving successful exits that not only preserved value but also set the stage for future growth.

One notable example is the case of a technology startup that specialized in cloud-based solutions. During a significant economic downturn, many businesses were tightening their budgets and cutting back on technology spending. However, this startup recognized a shift in demand as companies sought to streamline operations and reduce overhead costs. By pivoting its marketing strategy to emphasize cost savings and operational efficiency, the company was able to attract new clients who were looking for ways to adapt to the changing economic landscape. This strategic repositioning not only helped the company maintain its revenue stream but also made it an attractive acquisition target for a larger tech firm seeking to expand its portfolio in a recession-resistant sector. Ultimately, the exit was executed at a premium, demonstrating that agility and foresight can lead to successful outcomes even in challenging times.

Another compelling case involves a consumer goods company that faced significant headwinds during an economic downturn. As consumer spending declined, many brands struggled to maintain their market share. However, this company took a different approach by focusing on its core values and emphasizing sustainability. By enhancing its product line with eco-friendly options and launching a marketing campaign that resonated with environmentally conscious consumers, the company not only retained its existing customer base but also attracted new customers who prioritized sustainability. This strategic focus on a niche market allowed the company to differentiate itself from competitors and ultimately led to a successful exit through a merger with a larger corporation that shared its values. This case exemplifies how aligning business strategies with emerging consumer trends can create pathways to success, even when the broader economic environment is unfavorable.

Additionally, the story of a healthcare startup during an economic downturn highlights the importance of timing and adaptability. As the pandemic unfolded, the demand for telehealth services surged, presenting a unique opportunity for this company. Recognizing the shift in healthcare delivery, the startup quickly scaled its operations and enhanced its technology platform to meet the growing needs of patients and providers. By doing so, it positioned itself as a leader in the telehealth space. When the market stabilized, the company attracted significant interest from investors and ultimately achieved a successful exit through a strategic acquisition by a major healthcare provider looking to expand its digital offerings. This case underscores the critical role of agility and responsiveness in capitalizing on emerging trends, even amidst economic uncertainty.

These case studies serve as powerful reminders that economic downturns, while daunting, can also be fertile ground for innovation and strategic growth. By remaining vigilant and adaptable, portfolio companies can not only weather the storm but also emerge stronger and more resilient. The key lies in recognizing opportunities within challenges and being willing to pivot when necessary. As these examples illustrate, successful exits during economic downturns are not merely a matter of luck; they are the result of strategic foresight, adaptability, and a deep understanding of market dynamics. In navigating these complexities, companies can not only survive but thrive, paving the way for future success in an ever-evolving landscape.

Q&A

1. Question: What is an exit strategy in the context of portfolio companies?

Answer: An exit strategy is a plan for how investors will realize a return on their investment in a portfolio company, typically through methods such as selling the company, merging, or going public.

2. Question: Why is it important to adapt exit strategies during economic downturns?

Answer: Economic downturns can significantly affect company valuations and market conditions, necessitating adjustments to exit strategies to maximize returns and minimize losses.

3. Question: What are some common exit strategies that can be adapted during a downturn?

Answer: Common exit strategies include strategic sales to competitors, secondary buyouts by private equity firms, or recapitalization to provide liquidity while retaining ownership.

4. Question: How can portfolio companies enhance their attractiveness to buyers during a downturn?

Answer: Portfolio companies can enhance attractiveness by focusing on operational efficiencies, maintaining strong cash flow, and demonstrating resilience in their business model.

5. Question: What role does timing play in adapting exit strategies during economic downturns?

Answer: Timing is crucial; exiting too early may result in lower valuations, while waiting too long can lead to missed opportunities as market conditions may worsen.

6. Question: How can communication with stakeholders be managed during a downturn?

Answer: Clear and transparent communication with stakeholders, including investors and employees, is essential to maintain trust and align expectations regarding potential exit strategies.

7. Question: What metrics should be monitored to inform exit strategy adaptations during economic downturns?

Answer: Key metrics include cash flow, profitability, market trends, competitive positioning, and overall economic indicators to assess the viability of different exit options.

Conclusion

In conclusion, adapting exit strategies for portfolio companies during economic downturns is crucial for maximizing value and ensuring long-term sustainability. Investors must remain flexible, reassess market conditions, and consider alternative exit options such as strategic partnerships, secondary sales, or delayed exits to navigate challenges effectively. By prioritizing resilience and strategic planning, portfolio companies can better position themselves for recovery and future growth, ultimately enhancing returns for stakeholders.

Exit Timing Valuation Strategies Successful Exits Tailored Strategies Diversifying Options

Related Topics

Images sourced via Pexels.

Leave a Reply