-

Table of Contents – Cost-Effective Cloud Solutions

- Budgeting Best Practices

- Cost-Effective Cloud Solutions for Fintech Startups

- Strategies for Scaling Fintech Applications in the Cloud

- Optimizing Cloud Resource Allocation for Financial Services

- Leveraging Multi-Cloud Environments for Cost Savings

- Best Practices for Budgeting in Fintech Cloud Deployments

- Automating Cost Management in Fintech Cloud Services

- Evaluating Cloud Providers for Scalability and Cost Efficiency

- Q&A

- Conclusion

This article on Fintech cloud services Scalability Strategies also touches on related topics like Scalability Strategies, Cost-Effective Cloud Solutions, Fintech Growth Empowerment, Budgeting Best Practices.

“Empower Your Growth: Maximize Cost-Effectiveness and Scalability with Fintech Cloud Solutions.” Scalability Strategies is a foundational topic here. Fintech Growth Empowerment is equally relevant.

In the rapidly evolving landscape of financial technology, maximizing cost-effectiveness and scalability in cloud services has become paramount for organizations seeking to maintain a competitive edge. As fintech companies increasingly rely on cloud infrastructure to support their operations, the ability to efficiently manage resources while ensuring robust performance is critical. Cost-effectiveness allows businesses to optimize their expenditures, enabling them to allocate funds toward innovation and growth. Simultaneously, scalability ensures that these organizations can adapt to fluctuating demands and expand their services without compromising quality or security. By leveraging advanced cloud solutions, fintech firms can achieve a harmonious balance between operational efficiency and the flexibility needed to navigate the dynamic financial ecosystem.

Cost-Effective Cloud Solutions for Fintech Startups

In the rapidly evolving landscape of financial technology, startups are increasingly turning to cloud services as a means to enhance their operational efficiency and scalability. The allure of cost-effective cloud solutions is particularly strong for fintech startups, which often operate under tight budgets and the pressing need to innovate. By leveraging cloud technology, these startups can not only reduce their initial capital expenditures but also gain access to a suite of tools and resources that can propel their growth.

One of the primary advantages of cloud services is the pay-as-you-go model, which allows fintech startups to only pay for the resources they use. This flexibility is crucial for new companies that may experience fluctuating demand as they test their products in the market. Instead of investing heavily in on-premises infrastructure, which can be both costly and time-consuming to set up, startups can quickly deploy applications and services in the cloud. This not only accelerates time-to-market but also enables them to pivot and adapt their offerings based on real-time feedback from users.

Moreover, cloud providers often offer a range of services tailored specifically for the fintech sector, including advanced security features, compliance tools, and data analytics capabilities. These services can be particularly beneficial for startups that may lack the resources to develop such solutions in-house. By utilizing these built-in features, fintech startups can ensure that they meet regulatory requirements while also safeguarding sensitive customer data. This not only builds trust with users but also positions the startup as a credible player in a competitive market.

As startups grow, their needs will inevitably change, and this is where the scalability of cloud solutions becomes a game-changer. Cloud platforms allow for seamless scaling of resources, meaning that as a startup’s user base expands, it can easily increase its computing power, storage, and bandwidth without the need for significant upfront investment. This scalability ensures that startups can maintain performance and reliability, even during peak usage times, which is essential for retaining customers and fostering loyalty.

In addition to scalability, cloud services often come with built-in collaboration tools that can enhance productivity among teams. Fintech startups typically operate with small, agile teams that require efficient communication and collaboration to drive innovation. Cloud-based solutions facilitate real-time collaboration, enabling team members to work together seamlessly, regardless of their physical location. This not only fosters a culture of innovation but also allows for diverse talent to contribute to the startup’s mission, further enhancing its competitive edge.

Furthermore, the integration of artificial intelligence and machine learning capabilities within cloud platforms can provide fintech startups with valuable insights into customer behavior and market trends. By harnessing these advanced technologies, startups can make data-driven decisions that enhance their product offerings and marketing strategies. This ability to analyze vast amounts of data quickly and effectively can set a startup apart from its competitors, allowing it to identify opportunities and respond to challenges with agility.

In conclusion, the cost-effective cloud solutions available to fintech startups are not merely a means to reduce expenses; they represent a strategic advantage that can drive innovation and growth. By embracing cloud technology, these startups can maximize their operational efficiency, scale their services seamlessly, and leverage advanced tools that enhance their competitive positioning. As the fintech landscape continues to evolve, those who harness the power of the cloud will be well-equipped to navigate the challenges ahead and seize the opportunities that lie in wait.

Strategies for Scaling Fintech Applications in the Cloud

In the rapidly evolving landscape of financial technology, the ability to scale applications efficiently in the cloud is paramount for success. As fintech companies strive to meet the demands of an increasingly digital world, they must adopt strategies that not only enhance their operational capabilities but also ensure cost-effectiveness. One of the most effective approaches to achieving this is through the implementation of microservices architecture. By breaking down applications into smaller, independent services, fintech firms can deploy updates and new features more rapidly, allowing them to respond to market changes and customer needs with agility. This modular approach not only facilitates scalability but also optimizes resource utilization, as each service can be scaled independently based on demand.

Moreover, leveraging containerization technologies, such as Docker and Kubernetes, can further enhance the scalability of fintech applications. These tools allow developers to package applications and their dependencies into containers, ensuring consistency across different environments. As a result, fintech companies can deploy their applications seamlessly, whether in development, testing, or production. This consistency not only reduces the risk of errors but also accelerates the deployment process, enabling firms to bring new features to market faster. Additionally, container orchestration platforms like Kubernetes provide automated scaling capabilities, allowing applications to adjust resources dynamically based on real-time traffic and usage patterns. This responsiveness is crucial in the fintech sector, where transaction volumes can fluctuate dramatically.

In tandem with these technological advancements, adopting a cloud-native approach is essential for maximizing cost-effectiveness. By utilizing cloud services that are designed specifically for scalability, fintech companies can take advantage of pay-as-you-go pricing models. This means that organizations only pay for the resources they consume, which can lead to significant cost savings, especially during periods of low demand. Furthermore, cloud providers often offer a range of services, from data storage to machine learning capabilities, that can be integrated seamlessly into existing applications. This flexibility allows fintech firms to innovate without the burden of heavy upfront investments in infrastructure.

Another critical strategy for scaling fintech applications in the cloud is the implementation of robust monitoring and analytics tools. By continuously tracking application performance and user behavior, companies can identify bottlenecks and areas for improvement. This data-driven approach enables organizations to make informed decisions about resource allocation and scaling strategies. For instance, if analytics reveal that a particular service is experiencing high traffic, the company can proactively allocate additional resources to ensure optimal performance. This not only enhances user experience but also builds trust with customers, a vital component in the competitive fintech landscape.

Collaboration and communication among teams also play a significant role in scaling fintech applications effectively. By fostering a culture of collaboration, organizations can ensure that development, operations, and business teams work together seamlessly. This alignment is crucial for identifying scaling opportunities and addressing challenges promptly. Agile methodologies, which emphasize iterative development and cross-functional teamwork, can further enhance this collaborative spirit, allowing fintech companies to adapt quickly to changing market conditions.

In conclusion, the journey toward maximizing cost-effectiveness and scalability in fintech cloud services is multifaceted. By embracing microservices architecture, leveraging containerization, adopting cloud-native strategies, utilizing monitoring tools, and fostering collaboration, fintech companies can position themselves for success in a competitive environment. As they navigate this dynamic landscape, the ability to scale applications efficiently will not only drive growth but also empower them to deliver innovative solutions that meet the evolving needs of their customers. Ultimately, the future of fintech lies in the hands of those who dare to innovate and adapt, harnessing the power of the cloud to transform their visions into reality.

Optimizing Cloud Resource Allocation for Financial Services

In the rapidly evolving landscape of financial technology, the optimization of cloud resource allocation has emerged as a pivotal strategy for organizations seeking to enhance their cost-effectiveness and scalability. As financial services increasingly migrate to the cloud, the ability to efficiently manage and allocate resources becomes essential not only for operational efficiency but also for maintaining a competitive edge. By leveraging advanced cloud technologies, financial institutions can streamline their operations, reduce overhead costs, and ultimately deliver better services to their clients.

To begin with, understanding the specific needs of a financial organization is crucial in optimizing cloud resource allocation. Each institution has unique requirements based on its size, customer base, and the range of services it offers. By conducting a thorough analysis of these needs, organizations can tailor their cloud infrastructure to ensure that resources are allocated where they are most needed. This targeted approach not only minimizes waste but also maximizes the performance of applications and services, leading to improved customer satisfaction.

Moreover, adopting a dynamic resource allocation strategy can significantly enhance the scalability of financial services. In a sector characterized by fluctuating demand, the ability to scale resources up or down in real-time is invaluable. For instance, during peak transaction periods, such as holiday seasons or major sales events, financial institutions can quickly increase their cloud resources to handle the surge in activity. Conversely, during quieter times, they can scale back, ensuring that they are not incurring unnecessary costs. This flexibility not only supports operational efficiency but also allows organizations to respond swiftly to market changes, thereby fostering innovation and growth.

In addition to dynamic allocation, implementing automation tools can further optimize cloud resource management. Automation can streamline processes such as load balancing, resource provisioning, and monitoring, reducing the need for manual intervention. By automating these tasks, financial institutions can free up valuable human resources to focus on strategic initiatives rather than routine maintenance. Furthermore, automated systems can analyze usage patterns and predict future resource needs, enabling organizations to proactively adjust their allocations and avoid potential bottlenecks.

Transitioning to a cloud-native architecture can also play a significant role in optimizing resource allocation. By designing applications specifically for the cloud, financial institutions can take full advantage of the inherent scalability and flexibility that cloud environments offer. Microservices architecture, for example, allows organizations to deploy individual components of an application independently, making it easier to allocate resources based on specific demands. This modular approach not only enhances performance but also simplifies the process of scaling applications as needed.

Collaboration with cloud service providers is another critical aspect of optimizing resource allocation. By working closely with these providers, financial institutions can gain insights into best practices and leverage advanced tools designed to enhance resource management. Many cloud providers offer analytics and monitoring solutions that can help organizations track their resource usage in real-time, identify inefficiencies, and make data-driven decisions to optimize their cloud environments.

Ultimately, the journey toward maximizing cost-effectiveness and scalability in fintech cloud services hinges on the strategic optimization of cloud resource allocation. By understanding their unique needs, embracing dynamic and automated solutions, adopting cloud-native architectures, and collaborating with service providers, financial institutions can position themselves for success in an increasingly competitive market. As they navigate this transformative landscape, organizations that prioritize resource optimization will not only enhance their operational efficiency but also unlock new opportunities for innovation and growth, paving the way for a more resilient and agile future in financial services.

Leveraging Multi-Cloud Environments for Cost Savings

In the rapidly evolving landscape of financial technology, the adoption of cloud services has become a cornerstone for innovation and efficiency. As fintech companies strive to maximize cost-effectiveness and scalability, leveraging multi-cloud environments emerges as a strategic approach that not only enhances operational flexibility but also drives significant cost savings. By distributing workloads across multiple cloud providers, organizations can tap into the unique strengths of each platform, optimizing their resources while minimizing expenses.

One of the primary advantages of a multi-cloud strategy is the ability to avoid vendor lock-in. When fintech companies rely solely on a single cloud provider, they may find themselves constrained by that provider’s pricing structures and service limitations. In contrast, a multi-cloud approach allows organizations to negotiate better terms and select the most cost-effective services for specific needs. For instance, one provider may offer superior data storage solutions at a lower price, while another excels in processing power. By strategically choosing the right services from different providers, companies can create a tailored solution that maximizes value and minimizes costs.

Moreover, multi-cloud environments enable fintech firms to enhance their disaster recovery and business continuity plans. By distributing data and applications across various cloud platforms, organizations can ensure that their operations remain resilient in the face of unexpected disruptions. This redundancy not only safeguards critical financial data but also reduces the potential costs associated with downtime. In an industry where every second counts, the ability to maintain seamless operations can translate into significant financial savings and improved customer trust.

Transitioning to a multi-cloud strategy also fosters innovation by providing access to a broader range of tools and technologies. Each cloud provider offers unique features and capabilities, from advanced machine learning algorithms to cutting-edge security protocols. By leveraging these diverse resources, fintech companies can experiment with new solutions and rapidly iterate on their offerings. This agility not only enhances their competitive edge but also allows them to respond more effectively to market demands, ultimately driving growth and profitability.

Furthermore, the scalability inherent in multi-cloud environments is a game-changer for fintech organizations. As businesses grow and evolve, their cloud needs will inevitably change. A multi-cloud strategy allows companies to scale their operations seamlessly, adding or reducing resources as necessary without the constraints of a single provider. This flexibility is particularly crucial in the fintech sector, where market conditions can shift rapidly, and the ability to adapt is paramount. By utilizing multiple cloud services, organizations can ensure that they are always equipped to meet the demands of their customers and stakeholders.

In addition to these benefits, adopting a multi-cloud approach can lead to enhanced security and compliance. Different cloud providers often have varying security measures and compliance certifications, allowing fintech companies to choose the best options for their specific regulatory requirements. By distributing sensitive data across multiple platforms, organizations can also reduce the risk of a single point of failure, thereby bolstering their overall security posture.

In conclusion, leveraging multi-cloud environments presents a powerful opportunity for fintech companies to maximize cost-effectiveness and scalability. By strategically selecting services from various providers, organizations can optimize their resources, enhance resilience, foster innovation, and ensure compliance. As the fintech landscape continues to evolve, embracing a multi-cloud strategy will not only drive operational efficiency but also position companies for long-term success in an increasingly competitive market.

Best Practices for Budgeting in Fintech Cloud Deployments

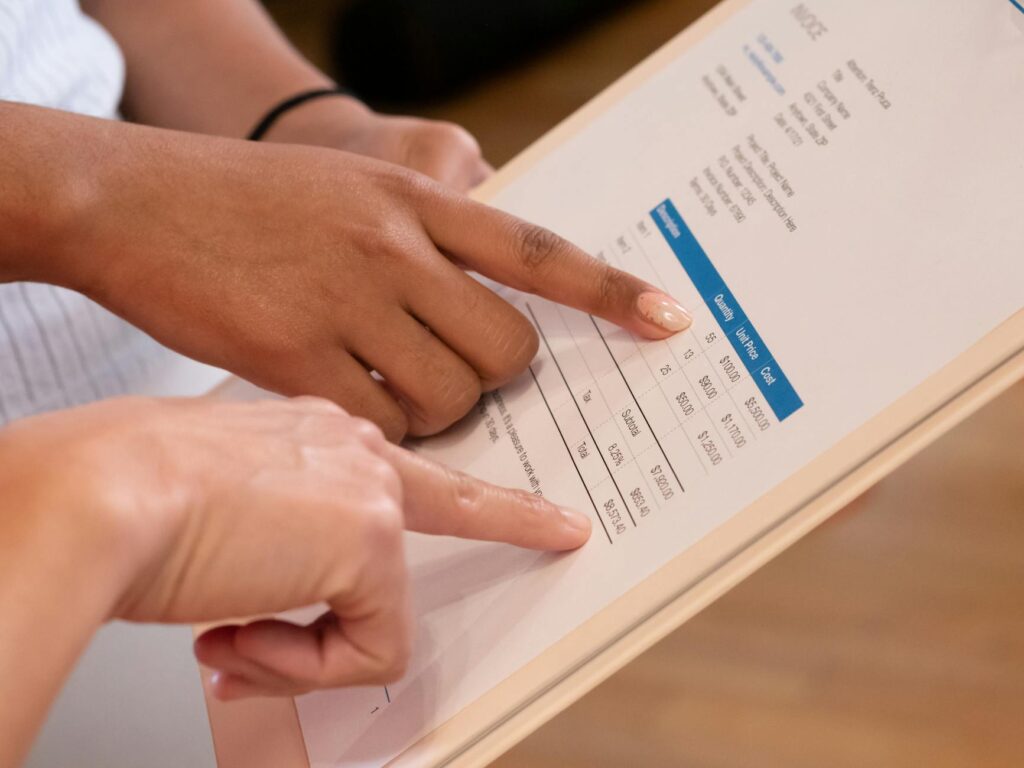

In the rapidly evolving landscape of fintech, where innovation and efficiency are paramount, budgeting for cloud deployments becomes a critical component of success. As organizations strive to maximize cost-effectiveness and scalability, adopting best practices in budgeting can significantly enhance their operational capabilities. To begin with, understanding the unique financial dynamics of cloud services is essential. Unlike traditional IT infrastructure, cloud services operate on a pay-as-you-go model, which can lead to both savings and unexpected costs if not managed properly. Therefore, establishing a clear budget framework that accounts for both fixed and variable expenses is crucial.

One effective strategy is to conduct a thorough assessment of current and projected cloud usage. By analyzing historical data and forecasting future needs, fintech companies can create a more accurate budget that reflects their operational requirements. This proactive approach not only helps in identifying potential cost-saving opportunities but also allows organizations to allocate resources more efficiently. Furthermore, leveraging cloud cost management tools can provide real-time insights into spending patterns, enabling teams to make informed decisions and adjust their budgets accordingly.

In addition to monitoring usage, it is vital to prioritize transparency across all departments involved in cloud deployments. Encouraging collaboration between finance, IT, and operational teams fosters a culture of accountability and ensures that everyone is aligned with the organization’s financial goals. By sharing budgetary information and insights, teams can identify areas where costs can be reduced without compromising service quality. This collaborative approach not only enhances financial discipline but also empowers employees to take ownership of their respective budgets, ultimately driving a more cost-effective cloud strategy.

Moreover, adopting a phased approach to cloud deployment can significantly mitigate financial risks. Instead of committing to a full-scale implementation from the outset, organizations can start with a pilot project to test the waters. This allows for the identification of potential challenges and the refinement of budgeting strategies before scaling up. By iterating on the deployment process, fintech companies can better understand their cloud consumption patterns and adjust their budgets in real-time, ensuring that they remain agile and responsive to changing market conditions.

As organizations scale their cloud services, it is also essential to consider the long-term implications of vendor contracts. Engaging in negotiations with cloud service providers can lead to more favorable pricing structures, especially for companies that anticipate significant growth. By securing volume discounts or committing to longer-term contracts, fintech firms can achieve substantial savings that contribute to overall budget efficiency. Additionally, regularly reviewing vendor performance and exploring alternative providers can help organizations stay competitive and cost-effective in a crowded marketplace.

Finally, fostering a culture of continuous improvement is vital for maintaining budget discipline in fintech cloud deployments. Regularly revisiting budgeting practices and incorporating feedback from stakeholders can lead to innovative solutions that enhance cost-effectiveness. By embracing a mindset of adaptability and learning, organizations can navigate the complexities of cloud budgeting with confidence, ensuring that they remain at the forefront of the fintech revolution.

In conclusion, maximizing cost-effectiveness and scalability in fintech cloud services hinges on effective budgeting practices. By assessing usage, promoting transparency, adopting a phased approach, negotiating with vendors, and fostering continuous improvement, organizations can create a robust financial framework that supports their growth ambitions. As the fintech landscape continues to evolve, those who prioritize strategic budgeting will not only thrive but also inspire others to follow suit in this dynamic industry.

Automating Cost Management in Fintech Cloud Services

In the rapidly evolving landscape of fintech, the integration of cloud services has become a cornerstone for innovation and efficiency. However, as organizations embrace these technologies, the challenge of managing costs effectively while ensuring scalability looms large. One of the most promising strategies to address this challenge is the automation of cost management in fintech cloud services. By leveraging automation, companies can not only streamline their operations but also enhance their financial performance, paving the way for sustainable growth.

To begin with, automating cost management allows fintech companies to gain real-time visibility into their cloud expenditures. Traditional methods of tracking costs often involve manual processes that are not only time-consuming but also prone to errors. By implementing automated tools, organizations can monitor their spending patterns continuously, identifying anomalies and inefficiencies as they arise. This proactive approach enables businesses to make informed decisions, ensuring that resources are allocated effectively and that unnecessary expenses are minimized.

Moreover, automation facilitates the optimization of resource utilization. In a cloud environment, resources can be easily scaled up or down based on demand. However, without proper oversight, companies may end up over-provisioning or under-utilizing their resources, leading to inflated costs. Automated cost management systems can analyze usage data and recommend adjustments in real-time, ensuring that organizations only pay for what they need. This not only enhances cost-effectiveness but also supports scalability, as businesses can respond swiftly to changing market conditions without incurring excessive costs.

In addition to optimizing resource allocation, automation can also enhance budgeting and forecasting processes. By utilizing advanced analytics and machine learning algorithms, fintech companies can predict future cloud expenditures with greater accuracy. This predictive capability allows organizations to set more realistic budgets and allocate funds strategically, ensuring that they are prepared for both anticipated growth and unforeseen challenges. As a result, businesses can maintain financial agility, which is crucial in the fast-paced fintech sector.

Furthermore, automating cost management fosters a culture of accountability within organizations. When teams have access to transparent, real-time data regarding cloud spending, they are more likely to take ownership of their budgets and make cost-conscious decisions. This shift in mindset not only drives efficiency but also encourages innovation, as teams are empowered to explore new solutions without the fear of spiraling costs. By creating an environment where financial responsibility is shared, fintech companies can cultivate a more sustainable approach to growth.

As we look to the future, the importance of automating cost management in fintech cloud services cannot be overstated. The ability to harness technology to streamline operations and enhance financial oversight is a game-changer for organizations striving to remain competitive. By embracing automation, fintech companies can not only maximize cost-effectiveness but also position themselves for scalable success in an increasingly complex market.

In conclusion, the journey toward maximizing cost-effectiveness and scalability in fintech cloud services is paved with opportunities for innovation and growth. By automating cost management, organizations can achieve greater visibility, optimize resource utilization, enhance budgeting processes, and foster a culture of accountability. As fintech continues to evolve, those who embrace these strategies will not only navigate the challenges of today but will also be well-equipped to seize the opportunities of tomorrow. The future of fintech is bright, and with the right tools and mindset, companies can thrive in this dynamic landscape.

Evaluating Cloud Providers for Scalability and Cost Efficiency

In the rapidly evolving landscape of fintech, the choice of cloud service providers plays a pivotal role in determining an organization’s success. As businesses strive to maximize cost-effectiveness and scalability, evaluating cloud providers becomes a critical task that requires careful consideration. The right cloud provider can not only enhance operational efficiency but also empower fintech companies to innovate and grow without the constraints of traditional infrastructure.

To begin with, understanding the specific needs of your fintech operation is essential. Each organization has unique requirements based on its size, target market, and the services it offers. By conducting a thorough assessment of these needs, businesses can identify the key features and capabilities they require from a cloud provider. For instance, scalability is paramount in the fintech sector, where demand can fluctuate dramatically. A cloud provider that offers flexible scaling options allows companies to adjust their resources in real-time, ensuring they can meet customer demands without incurring unnecessary costs.

Moreover, cost efficiency is another critical factor that cannot be overlooked. Fintech companies often operate on tight margins, making it essential to choose a cloud provider that offers transparent pricing models. This transparency enables organizations to predict their expenses accurately and avoid unexpected charges. Additionally, many cloud providers offer pay-as-you-go pricing, which allows businesses to pay only for the resources they use. This model not only enhances cost-effectiveness but also aligns with the dynamic nature of fintech operations, where resource needs can change rapidly.

As organizations evaluate potential cloud providers, it is also important to consider their track record in the fintech industry. Providers with experience in this sector are more likely to understand the regulatory challenges and compliance requirements that fintech companies face. This understanding can translate into better support and tailored solutions that meet industry standards. Furthermore, a provider’s reputation for reliability and performance should be a key consideration. Downtime or slow performance can lead to significant financial losses and damage to customer trust, making it crucial to partner with a provider that has a proven history of uptime and responsiveness.

In addition to these factors, security and data protection are paramount in the fintech space. As organizations handle sensitive financial information, they must ensure that their cloud provider adheres to the highest security standards. This includes robust encryption, regular security audits, and compliance with relevant regulations such as GDPR or PCI DSS. By prioritizing security in their evaluation process, fintech companies can safeguard their data and maintain customer confidence.

Furthermore, the ability to integrate with existing systems and third-party applications is another vital aspect to consider. A cloud provider that offers seamless integration capabilities can enhance operational efficiency and streamline workflows. This flexibility allows fintech companies to leverage their existing technology investments while also exploring new innovations that can drive growth.

Ultimately, the evaluation of cloud providers for scalability and cost efficiency is a multifaceted process that requires careful analysis and strategic thinking. By taking the time to assess their specific needs, scrutinize pricing models, and prioritize security and integration capabilities, fintech organizations can make informed decisions that position them for success. In a world where agility and innovation are key, the right cloud partner can be a catalyst for transformation, enabling fintech companies to thrive in an increasingly competitive landscape. Embracing this journey not only enhances operational capabilities but also inspires a future where financial services are more accessible, efficient, and secure for everyone.

Q&A

1. Question: What is cost-effectiveness in fintech cloud services?

Answer: Cost-effectiveness in fintech cloud services refers to the ability to deliver financial services at a lower cost while maintaining quality and performance, often achieved through efficient resource utilization and pricing models.

2. Question: How can fintech companies achieve scalability in cloud services?

Answer: Fintech companies can achieve scalability by leveraging cloud infrastructure that allows for on-demand resource allocation, enabling them to handle varying workloads without significant upfront investment.

3. Question: What role does automation play in maximizing cost-effectiveness?

Answer: Automation reduces manual intervention, streamlines operations, and minimizes errors, leading to lower operational costs and improved efficiency in fintech cloud services.

4. Question: How can fintech firms optimize their cloud spending?

Answer: Fintech firms can optimize cloud spending by implementing cost monitoring tools, utilizing reserved instances, and regularly reviewing resource usage to eliminate waste.

5. Question: What are the benefits of using a multi-cloud strategy for scalability?

Answer: A multi-cloud strategy enhances scalability by allowing fintech firms to distribute workloads across different cloud providers, improving redundancy, flexibility, and access to specialized services.

6. Question: How does data management impact cost-effectiveness in fintech cloud services?

Answer: Effective data management reduces storage costs, improves data retrieval speeds, and ensures compliance, all of which contribute to overall cost-effectiveness in fintech operations.

7. Question: What is the significance of compliance in maximizing cost-effectiveness?

Answer: Compliance with regulatory standards prevents costly fines and legal issues, ensuring that fintech companies can operate efficiently and maintain customer trust, which is essential for long-term cost-effectiveness.

Conclusion

Maximizing cost-effectiveness and scalability in fintech cloud services requires a strategic approach that leverages cloud-native technologies, automation, and data analytics. By adopting a pay-as-you-go pricing model, fintech companies can optimize their resource allocation and reduce operational costs. Implementing microservices architecture allows for greater flexibility and scalability, enabling firms to quickly adapt to market demands and customer needs. Additionally, utilizing advanced analytics can enhance decision-making processes and improve service delivery. Ultimately, a focus on these principles not only drives financial efficiency but also positions fintech companies for sustainable growth in a competitive landscape.

Cloud Resource Allocation Containerization Technologies Multi-Cloud Environments Cost Management Automation Cloud Providers Evaluation

Related Topics

Images sourced via Pexels.

Leave a Reply