-

Table of Contents – diversifying portfolio

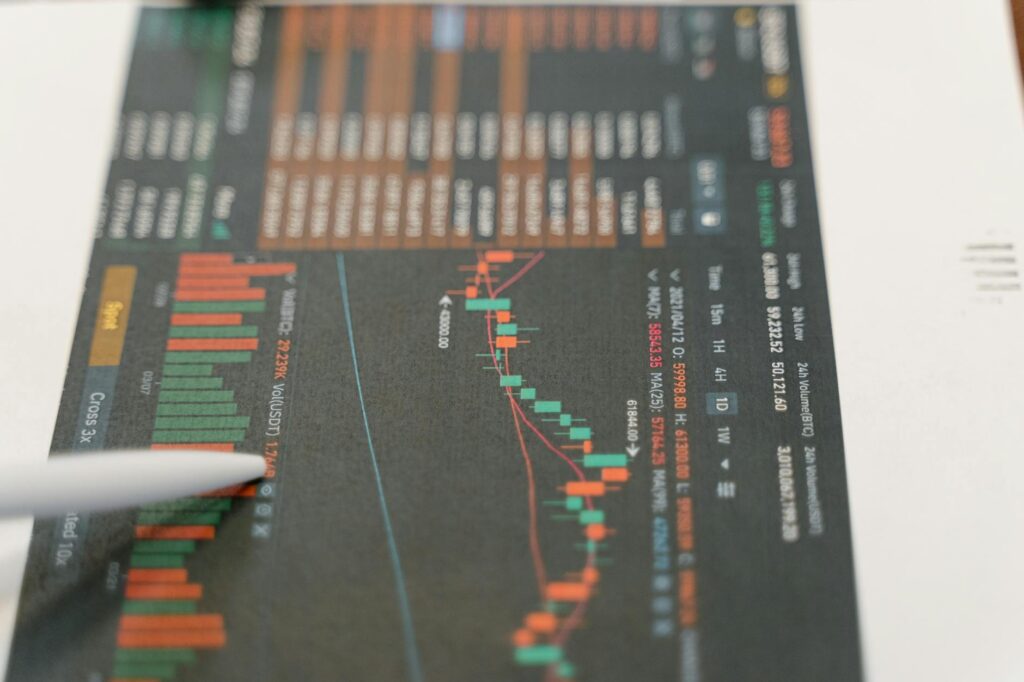

This article on Adjusting exit strategy for portfolio companies also touches on related topics like Q&A, diversifying portfolio, exit strategy, Market fluctuations.

“Steer Your Success: Mastering Exit Strategies Amid Market Volatility.” Q&A is a foundational topic here. Exit strategy is equally relevant.

In today’s dynamic financial landscape, sudden market fluctuations can significantly impact the performance and valuation of portfolio companies. Investors and fund managers must be agile in their approach, adapting their exit strategies to mitigate risks and capitalize on emerging opportunities. This introduction explores the critical importance of reassessing exit strategies in response to market volatility, highlighting key considerations such as timing, market conditions, and the unique characteristics of each portfolio company. By understanding how to navigate these fluctuations effectively, investors can enhance their decision-making processes and optimize returns, ensuring that their exit strategies remain robust and responsive in an ever-changing environment.

Understanding Market Fluctuations

Market fluctuations are an inherent part of the financial landscape, characterized by the unpredictable rise and fall of asset prices. These fluctuations can be triggered by a myriad of factors, including economic indicators, geopolitical events, and shifts in consumer sentiment. Understanding these dynamics is crucial for investors, particularly those managing portfolio companies, as they navigate the complexities of the market. When faced with sudden changes, it becomes essential to adapt strategies to safeguard investments and capitalize on emerging opportunities.

To begin with, recognizing the nature of market fluctuations is vital. Markets are influenced by both macroeconomic trends and microeconomic factors. For instance, a sudden change in interest rates can ripple through various sectors, affecting everything from consumer spending to corporate profitability. Similarly, global events, such as political unrest or natural disasters, can create uncertainty, leading to rapid price adjustments. By staying informed about these influences, investors can better anticipate potential market movements and adjust their strategies accordingly.

Moreover, it is important to acknowledge that not all fluctuations are negative. While downturns can be alarming, they often present unique opportunities for savvy investors. For example, a temporary dip in stock prices may allow for the acquisition of undervalued assets, setting the stage for future growth. This perspective encourages a proactive approach, where investors view market volatility not merely as a threat but as a chance to refine their portfolios. Embracing this mindset can lead to more informed decision-making and ultimately enhance long-term returns.

In addition to understanding the causes of market fluctuations, investors must also consider the psychological aspects that drive market behavior. Investor sentiment can significantly impact market dynamics, often leading to irrational decisions based on fear or greed. During periods of volatility, it is common for investors to react impulsively, selling off assets in a panic or holding onto losing positions out of hope. By cultivating emotional intelligence and maintaining a disciplined approach, investors can resist the urge to make hasty decisions. Instead, they can focus on their long-term objectives and adhere to their strategic plans.

As market conditions shift, it becomes increasingly important to revisit and adjust exit strategies for portfolio companies. An effective exit strategy should be flexible enough to accommodate changing market realities while remaining aligned with the investor’s overall goals. For instance, if a portfolio company is experiencing rapid growth, it may be prudent to consider an earlier exit to capitalize on favorable market conditions. Conversely, if market sentiment turns negative, it may be wise to delay an exit, allowing time for recovery and potentially securing a better valuation.

Furthermore, leveraging data analytics and market research can provide valuable insights into timing and execution. By analyzing trends and performance metrics, investors can make more informed decisions about when to exit or hold onto their investments. This analytical approach not only enhances the likelihood of successful exits but also fosters a deeper understanding of the market landscape.

In conclusion, navigating sudden market fluctuations requires a blend of knowledge, emotional resilience, and strategic foresight. By understanding the underlying factors that drive market behavior and remaining adaptable in their exit strategies, investors can turn challenges into opportunities. Ultimately, embracing the ebb and flow of the market can lead to greater success and fulfillment in the investment journey.

Assessing Your Current Exit Strategy

In the ever-evolving landscape of investment, sudden market fluctuations can pose significant challenges for portfolio managers and investors alike. As these shifts occur, it becomes crucial to assess your current exit strategy to ensure that it aligns with the changing market dynamics. The first step in this assessment is to take a comprehensive inventory of your existing portfolio. By evaluating each company’s performance, market position, and growth potential, you can gain valuable insights into which investments may require a reevaluation of your exit approach.

Moreover, understanding the broader economic context is essential. Market fluctuations can be influenced by various factors, including geopolitical events, changes in consumer behavior, and shifts in regulatory environments. By staying informed about these external influences, you can better anticipate how they might impact your portfolio companies. This awareness allows you to make informed decisions about whether to hold, sell, or adjust your investment in response to market conditions.

As you assess your exit strategy, it is also important to consider the specific goals you have set for each investment. Are you aiming for short-term gains, or are you focused on long-term growth? Your objectives will significantly influence your exit strategy. For instance, if your goal is to maximize short-term returns, you may need to be more agile in your decision-making, ready to capitalize on favorable market conditions. Conversely, if you are committed to a long-term vision, it may be prudent to ride out temporary fluctuations, trusting in the underlying strength of your portfolio companies.

In addition to your goals, evaluating the performance metrics of your portfolio companies can provide critical insights. Key performance indicators such as revenue growth, profit margins, and market share can help you gauge whether a company is on track to meet its potential. If a company is underperforming, it may be time to reconsider your exit strategy. This could involve divesting from the company or seeking alternative strategies to enhance its value, such as bringing in new management or pivoting its business model.

Furthermore, engaging with industry experts and leveraging their insights can be invaluable during this assessment phase. By tapping into the knowledge of seasoned professionals, you can gain a deeper understanding of market trends and potential future developments. This collaborative approach not only enriches your perspective but also fosters a proactive mindset, enabling you to adapt your exit strategy in real-time.

As you navigate these complexities, it is essential to remain flexible and open to change. The ability to pivot your exit strategy in response to market fluctuations can be a significant advantage. Embracing a mindset of adaptability allows you to seize opportunities that may arise unexpectedly, turning potential challenges into avenues for growth.

Ultimately, assessing your current exit strategy is not merely a reactive measure; it is an opportunity for growth and refinement. By taking the time to evaluate your portfolio, understand market dynamics, and align your strategies with your investment goals, you position yourself to thrive in an unpredictable environment. In doing so, you not only safeguard your investments but also empower yourself to make informed decisions that can lead to long-term success. As you embark on this journey of assessment and adjustment, remember that every challenge presents an opportunity for innovation and resilience in the world of investment.

Identifying Key Indicators of Market Changes

In the ever-evolving landscape of investment, sudden market fluctuations can present both challenges and opportunities for portfolio managers. Understanding how to navigate these changes is crucial for maintaining a robust exit strategy. One of the first steps in this process is identifying key indicators of market changes. By honing in on these indicators, investors can make informed decisions that not only protect their assets but also position them for future growth.

To begin with, it is essential to monitor economic indicators that signal shifts in market conditions. For instance, changes in interest rates can have a profound impact on investment valuations. When central banks adjust rates, it often reflects broader economic trends, such as inflation or recession. By keeping a close eye on these adjustments, investors can anticipate how their portfolio companies might be affected. Additionally, employment data, consumer confidence indices, and GDP growth rates serve as vital barometers of economic health. A sudden spike in unemployment or a dip in consumer spending can foreshadow a downturn, prompting a reevaluation of exit strategies.

Moreover, sector-specific trends can provide valuable insights into potential market shifts. For example, technological advancements or regulatory changes can disrupt entire industries, creating both risks and opportunities. Investors should remain vigilant about developments within their portfolio sectors, as these changes can influence the timing and method of exit. By staying informed about industry news and emerging trends, investors can better position themselves to respond proactively to market fluctuations.

In addition to macroeconomic and sector-specific indicators, investor sentiment plays a critical role in market dynamics. The psychology of the market can often lead to rapid price movements, driven by fear or exuberance. Monitoring sentiment indicators, such as the volatility index (VIX) or consumer sentiment surveys, can provide insights into market psychology. When fear grips the market, it may be an opportune moment to reassess exit strategies, as panic selling can create undervalued opportunities. Conversely, during periods of high optimism, it may be wise to consider taking profits before a potential correction.

Furthermore, technological tools and data analytics have revolutionized the way investors track market changes. Utilizing advanced analytics can help identify patterns and correlations that may not be immediately apparent. By leveraging these tools, investors can gain a deeper understanding of market dynamics and make data-driven decisions regarding their exit strategies. This analytical approach not only enhances decision-making but also instills confidence in navigating uncertain waters.

As investors refine their ability to identify key indicators of market changes, it is equally important to remain adaptable. The investment landscape is inherently unpredictable, and flexibility is paramount. By developing a responsive exit strategy that can be adjusted based on real-time data and insights, investors can better weather market fluctuations. This adaptability not only protects investments but also opens doors to new opportunities that may arise during turbulent times.

In conclusion, identifying key indicators of market changes is a vital component of adjusting exit strategies for portfolio companies. By staying attuned to economic indicators, sector trends, investor sentiment, and leveraging technology, investors can navigate sudden market fluctuations with confidence. Embracing this proactive approach not only safeguards investments but also empowers investors to seize opportunities that may emerge in the face of uncertainty. Ultimately, the ability to adapt and respond to market changes is what distinguishes successful investors in an ever-changing financial landscape.

Adapting to Economic Shifts

In the ever-evolving landscape of investment, sudden market fluctuations can present both challenges and opportunities for portfolio companies. As economic conditions shift, it becomes imperative for investors to adapt their exit strategies accordingly. The ability to pivot in response to these changes not only safeguards investments but can also enhance potential returns. Understanding the nuances of economic shifts is crucial for making informed decisions that align with both current market realities and long-term goals.

When faced with unexpected market volatility, the first step is to assess the underlying factors driving these changes. Economic indicators such as interest rates, inflation, and consumer confidence can significantly influence market dynamics. By staying informed about these indicators, investors can better anticipate potential impacts on their portfolio companies. For instance, a rise in interest rates may lead to increased borrowing costs for businesses, prompting a reevaluation of growth projections. Conversely, a surge in consumer spending could signal a favorable environment for certain sectors, encouraging a more aggressive exit strategy.

Moreover, it is essential to recognize that not all portfolio companies will respond uniformly to market fluctuations. Each company operates within its unique context, influenced by industry trends, competitive positioning, and operational resilience. Therefore, a tailored approach to exit strategies is necessary. Investors should conduct thorough analyses of each company’s performance metrics and market positioning to identify which entities may require a more cautious exit and which could benefit from a more opportunistic approach. This nuanced understanding allows for a more strategic allocation of resources and attention.

As investors navigate these economic shifts, communication with portfolio company leadership becomes paramount. Engaging in open dialogues can provide valuable insights into operational challenges and opportunities that may arise from changing market conditions. By fostering a collaborative relationship, investors can work alongside management teams to refine exit strategies that align with both immediate needs and long-term objectives. This partnership not only strengthens the overall investment thesis but also cultivates a culture of adaptability and resilience within the portfolio.

In addition to internal assessments, external market conditions should also inform exit strategies. For instance, during periods of economic uncertainty, potential acquirers may become more risk-averse, leading to a decrease in valuations. In such scenarios, it may be prudent to consider alternative exit routes, such as secondary sales or strategic partnerships, which could provide liquidity without compromising long-term value. By remaining flexible and open to various exit options, investors can navigate market fluctuations with greater confidence.

Ultimately, adapting to economic shifts requires a mindset that embraces change and innovation. Investors who view market fluctuations not as obstacles but as opportunities for growth are better positioned to thrive. By continuously refining exit strategies in response to evolving market conditions, investors can unlock new avenues for value creation. This proactive approach not only enhances the resilience of portfolio companies but also fosters a culture of agility that is essential in today’s fast-paced economic environment.

In conclusion, navigating sudden market fluctuations demands a thoughtful and adaptive approach to exit strategies. By staying informed, engaging with portfolio company leadership, and remaining open to alternative exit routes, investors can effectively respond to economic shifts. Embracing this dynamic landscape with a spirit of resilience and innovation will ultimately lead to more successful outcomes, ensuring that both investors and their portfolio companies can flourish amidst uncertainty.

Timing Your Exit: When to Act

In the ever-evolving landscape of investment, timing your exit from portfolio companies can be one of the most critical decisions an investor faces. Sudden market fluctuations can create both challenges and opportunities, making it essential to remain vigilant and adaptable. As you navigate these unpredictable waters, understanding when to act can significantly influence your overall success.

First and foremost, it is vital to stay informed about market trends and economic indicators. By keeping a close eye on the financial landscape, you can better anticipate potential shifts that may impact your portfolio companies. For instance, a sudden downturn in the economy might prompt you to reassess your exit strategy, while an unexpected surge in market demand could present an opportune moment to capitalize on your investments. This proactive approach not only helps you make informed decisions but also empowers you to act swiftly when the time is right.

Moreover, it is essential to establish clear performance metrics for your portfolio companies. By setting specific benchmarks, you can evaluate their progress and determine whether they are on track to meet your investment goals. If a company consistently exceeds expectations, it may be wise to consider an exit strategy that allows you to realize gains while the momentum is in your favor. Conversely, if a company is underperforming, it may be time to reassess your investment and explore alternative options. This analytical mindset will enable you to make data-driven decisions that align with your overall investment strategy.

In addition to monitoring performance metrics, it is crucial to remain attuned to external factors that may influence your exit timing. Economic shifts, regulatory changes, and technological advancements can all impact the viability of your portfolio companies. For example, a new regulation could create barriers for a company, prompting you to act sooner than anticipated. Conversely, a technological breakthrough might enhance a company’s prospects, encouraging you to hold on a bit longer. By staying informed about these external influences, you can better position yourself to make timely decisions that align with the evolving market landscape.

Furthermore, engaging with industry experts and networking with fellow investors can provide valuable insights into market dynamics. By sharing experiences and knowledge, you can gain a broader perspective on potential exit strategies. This collaborative approach not only enhances your understanding of market fluctuations but also fosters a sense of community among investors. As you exchange ideas and strategies, you may discover innovative ways to navigate sudden changes and optimize your exit timing.

Ultimately, the key to successfully timing your exit lies in balancing intuition with analysis. While data and metrics are essential, trusting your instincts can also play a significant role in decision-making. As you gain experience in the investment world, you will develop a sense of when to act and when to hold back. This intuitive understanding, combined with a solid analytical foundation, will empower you to make confident decisions that align with your investment goals.

In conclusion, navigating sudden market fluctuations requires a multifaceted approach to timing your exit from portfolio companies. By staying informed, establishing performance metrics, considering external factors, and engaging with industry peers, you can enhance your ability to make timely and strategic decisions. Embracing this dynamic process not only positions you for success but also inspires confidence in your investment journey. As you refine your exit strategy, remember that adaptability and foresight are your greatest allies in the ever-changing world of investment.

Diversifying Your Portfolio for Stability

In the ever-evolving landscape of investment, sudden market fluctuations can create a sense of uncertainty that challenges even the most seasoned investors. However, amidst this unpredictability lies an opportunity for growth and resilience, particularly through the strategic diversification of your portfolio. By embracing a diversified approach, investors can not only mitigate risks but also enhance the stability of their investments, ultimately leading to more informed and confident decision-making.

To begin with, diversification serves as a protective shield against the inherent volatility of the market. When you spread your investments across various asset classes—such as stocks, bonds, real estate, and commodities—you reduce the impact of a downturn in any single sector. For instance, if the technology sector experiences a sudden decline, having investments in healthcare or consumer goods can help cushion the blow. This principle of not putting all your eggs in one basket is fundamental to building a robust portfolio that can weather the storms of market fluctuations.

Moreover, diversifying your portfolio allows you to tap into different growth opportunities. Each sector and asset class has its own unique performance drivers, influenced by economic conditions, consumer behavior, and technological advancements. By investing in a mix of industries, you position yourself to benefit from various growth cycles. For example, while renewable energy may be on the rise due to increasing environmental awareness, traditional energy sectors may still provide stability during transitional phases. This balanced approach not only enhances your potential for returns but also fosters a sense of security in your investment strategy.

In addition to sector diversification, geographical diversification can further bolster your portfolio’s resilience. Investing in international markets exposes you to different economic conditions and growth trajectories. While domestic markets may face challenges, emerging markets can offer promising opportunities for expansion. By incorporating a global perspective into your investment strategy, you can navigate local market fluctuations more effectively and capitalize on growth trends that may not be present in your home country.

Furthermore, it is essential to consider the role of alternative investments in your diversification strategy. Assets such as private equity, hedge funds, and real estate investment trusts (REITs) can provide unique benefits that traditional stocks and bonds may not offer. These alternative investments often have low correlations with the broader market, meaning they can perform well even when traditional markets are struggling. By including these assets in your portfolio, you can enhance overall stability and create a more resilient investment framework.

As you navigate the complexities of sudden market fluctuations, it is crucial to remain adaptable and open to reassessing your exit strategy for portfolio companies. A well-diversified portfolio not only provides a buffer against volatility but also empowers you to make informed decisions about when to exit or hold onto your investments. By regularly reviewing your asset allocation and adjusting it in response to market conditions, you can ensure that your portfolio remains aligned with your long-term financial goals.

In conclusion, diversifying your portfolio is not merely a defensive strategy; it is an inspirational approach that encourages growth, resilience, and adaptability. By embracing a diversified investment strategy, you can navigate sudden market fluctuations with confidence, transforming potential challenges into opportunities for success. As you embark on this journey, remember that a well-rounded portfolio is not just about stability; it is about empowering yourself to thrive in an ever-changing financial landscape.

Lessons Learned from Past Market Crises

Navigating sudden market fluctuations can be a daunting task for investors, particularly when it comes to adjusting exit strategies for portfolio companies. However, history has provided us with valuable lessons from past market crises that can guide us in making informed decisions during turbulent times. By reflecting on these experiences, we can develop a more resilient approach to managing our investments and ultimately enhance our chances of success.

One of the most significant lessons learned from past market crises is the importance of maintaining a diversified portfolio. During the 2008 financial crisis, many investors witnessed the devastating effects of over-concentration in specific sectors. As certain industries plummeted, those who had diversified their investments across various sectors were better positioned to weather the storm. This experience underscores the necessity of not only diversifying across asset classes but also considering geographical and sectoral diversification. By spreading risk, investors can mitigate the impact of sudden market fluctuations and create a more stable foundation for their portfolios.

Moreover, the 2000 dot-com bubble serves as a poignant reminder of the dangers of emotional decision-making. Many investors were swept up in the euphoria of rapid technological advancements, leading them to overlook fundamental valuations. When the bubble burst, panic ensued, and countless investors suffered significant losses. This highlights the importance of maintaining a disciplined approach to investing, particularly during periods of market volatility. By adhering to a well-defined investment strategy and resisting the urge to react impulsively to market noise, investors can better navigate fluctuations and make more rational decisions regarding their exit strategies.

In addition to emotional discipline, the ability to adapt to changing market conditions is crucial. The COVID-19 pandemic illustrated how quickly market dynamics can shift, forcing investors to reassess their strategies. Companies that were once considered stable found themselves facing unprecedented challenges, while others emerged as unexpected winners. This situation emphasizes the need for continuous monitoring and evaluation of portfolio companies. By staying informed about market trends and being willing to pivot when necessary, investors can position themselves to capitalize on new opportunities while minimizing potential losses.

Furthermore, the importance of having a robust exit strategy cannot be overstated. The lessons from past crises reveal that a well-thought-out exit plan can significantly impact an investor’s ability to navigate market fluctuations. During the 2008 crisis, many investors were caught off guard, lacking a clear strategy for exiting their positions. In contrast, those who had established exit criteria based on market conditions and company performance were able to make timely decisions that preserved their capital. This reinforces the idea that proactive planning is essential for success in uncertain environments.

Lastly, the value of building strong relationships with portfolio company management teams cannot be overlooked. During times of crisis, effective communication and collaboration become paramount. Investors who maintain open lines of communication with management can gain insights into operational challenges and strategic pivots, allowing them to make more informed decisions regarding their exit strategies. This collaborative approach fosters trust and can lead to better outcomes for both investors and portfolio companies.

In conclusion, the lessons learned from past market crises serve as a guiding light for investors navigating sudden market fluctuations. By embracing diversification, maintaining emotional discipline, adapting to changing conditions, establishing robust exit strategies, and fostering strong relationships with management teams, investors can enhance their resilience in the face of uncertainty. Ultimately, these strategies not only prepare us for potential challenges but also inspire confidence in our ability to thrive in an ever-evolving market landscape.

Q&A

1. Question: What are sudden market fluctuations?

Answer: Sudden market fluctuations refer to rapid and significant changes in asset prices due to economic events, investor sentiment, or external shocks.

2. Question: How can sudden market fluctuations impact portfolio companies?

Answer: They can lead to decreased valuations, altered investor confidence, and potential liquidity issues, affecting the overall performance and exit opportunities for portfolio companies.

3. Question: What should be the first step in adjusting an exit strategy during market fluctuations?

Answer: The first step is to reassess the current market conditions and the specific factors driving the fluctuations to understand their potential impact on the portfolio companies.

4. Question: How can diversification help during market fluctuations?

Answer: Diversification can mitigate risk by spreading investments across various sectors or asset classes, reducing the overall impact of market volatility on the portfolio.

5. Question: What role does communication play in adjusting exit strategies?

Answer: Clear communication with stakeholders, including investors and management teams, is crucial to align expectations and make informed decisions regarding exit timing and strategy.

6. Question: When might it be advisable to delay an exit during market fluctuations?

Answer: It may be advisable to delay an exit if market conditions suggest that valuations will improve or if the portfolio company has strong fundamentals that could lead to recovery.

7. Question: What are some alternative exit strategies to consider during volatile markets?

Answer: Alternatives include secondary sales, recapitalizations, or strategic partnerships, which can provide liquidity without relying on traditional exit routes like IPOs or outright sales.

Conclusion

In conclusion, navigating sudden market fluctuations requires a proactive and adaptable approach to exit strategies for portfolio companies. Investors must continuously assess market conditions, reevaluate their risk tolerance, and consider alternative exit options, such as secondary sales or strategic partnerships, to maximize returns. By maintaining flexibility and staying informed about market trends, investors can effectively adjust their exit strategies to mitigate losses and capitalize on opportunities, ultimately enhancing the resilience and performance of their investment portfolios.

Related Topics

Images sourced via Pexels.

Leave a Reply