-

Table of Contents – investment strategies

This article on Property evaluation strategies for investment portfolio also touches on related topics like property condition evaluation, investment strategies, financial metrics, real estate market trends.

“Unlocking Value: Mastering Property Evaluation for Smart Investment Decisions.” Property condition evaluation is a foundational topic here. Financial metrics is equally relevant.

Evaluating properties for an investment portfolio is a critical process that involves analyzing various factors to determine the potential return on investment and overall viability of a property. This process includes assessing the property’s location, market trends, financial performance, and physical condition. Investors must consider key metrics such as cash flow, appreciation potential, and risk factors to make informed decisions. By employing a systematic approach to property evaluation, investors can identify opportunities that align with their financial goals and enhance their portfolio’s performance.

Market Analysis Techniques

When it comes to building a successful investment portfolio, understanding market analysis techniques is crucial. These techniques not only help investors identify potential opportunities but also enable them to make informed decisions that can lead to long-term financial success. To begin with, one of the most fundamental aspects of market analysis is understanding the local real estate market dynamics. This involves examining various factors such as supply and demand, economic indicators, and demographic trends. By analyzing these elements, investors can gain insights into which areas are poised for growth and which may be stagnating.

Furthermore, employing comparative market analysis (CMA) is an effective way to evaluate properties. This technique involves comparing similar properties in the same area to determine their market value. By looking at recent sales data, rental rates, and property features, investors can establish a baseline for what constitutes a fair price. This not only aids in identifying undervalued properties but also helps in negotiating better deals. As investors delve deeper into the CMA process, they may also uncover trends that indicate whether a neighborhood is on the rise or in decline, providing valuable context for their investment decisions.

In addition to CMA, utilizing data analytics tools can significantly enhance the evaluation process. With the advent of technology, investors now have access to a wealth of information at their fingertips. Online platforms provide data on property values, historical trends, and even predictive analytics that forecast future market movements. By leveraging these tools, investors can make data-driven decisions that minimize risk and maximize returns. Moreover, these insights can help investors identify emerging markets before they become mainstream, allowing them to capitalize on opportunities that others may overlook.

Another essential technique in market analysis is understanding the economic landscape. This involves keeping an eye on macroeconomic indicators such as employment rates, interest rates, and inflation. A strong economy typically correlates with a robust real estate market, as more people are likely to buy homes or invest in rental properties. Conversely, during economic downturns, property values may decline, making it imperative for investors to stay informed about broader economic trends. By aligning their investment strategies with economic cycles, investors can better position themselves to weather market fluctuations.

Moreover, networking with local real estate professionals can provide invaluable insights into market conditions. Real estate agents, property managers, and other industry experts often have firsthand knowledge of the nuances within specific neighborhoods. By building relationships with these professionals, investors can gain access to off-market deals and insider information that can significantly enhance their investment strategies. This collaborative approach not only enriches an investor’s understanding of the market but also fosters a sense of community within the real estate landscape.

As investors refine their market analysis techniques, it is essential to remain adaptable. The real estate market is constantly evolving, influenced by various factors such as technological advancements, changing consumer preferences, and shifts in government policies. By staying informed and being willing to adjust their strategies, investors can navigate these changes effectively. Ultimately, the key to successful property evaluation lies in a combination of thorough research, data analysis, and a keen understanding of market dynamics. By embracing these techniques, investors can build a resilient and profitable investment portfolio that stands the test of time.

Property Valuation Methods

When it comes to building a successful investment portfolio, understanding property valuation methods is crucial. The ability to accurately assess the value of a property not only informs your purchasing decisions but also enhances your overall investment strategy. There are several approaches to property valuation, each with its unique advantages and applications, allowing investors to make informed choices that align with their financial goals.

One of the most commonly used methods is the comparative market analysis (CMA). This approach involves examining the sale prices of similar properties in the same area, often referred to as “comps.” By analyzing these comparable properties, investors can gauge the market value of a potential investment. This method is particularly effective in active markets where properties are frequently bought and sold, as it provides a snapshot of current market trends. However, it is essential to consider factors such as location, property condition, and unique features that may influence value. By doing so, investors can refine their analysis and make more accurate assessments.

Another widely recognized method is the income approach, which is particularly relevant for rental properties or commercial real estate. This technique focuses on the income-generating potential of a property. Investors calculate the net operating income (NOI) by subtracting operating expenses from gross rental income. Once the NOI is established, it can be capitalized using a market-derived capitalization rate to determine the property’s value. This method emphasizes the importance of cash flow and can be particularly inspiring for those looking to build wealth through real estate. By understanding how to evaluate a property’s income potential, investors can make strategic decisions that enhance their portfolios.

In addition to these methods, the cost approach offers another perspective on property valuation. This approach estimates the value of a property based on the cost to replace or reproduce it, minus any depreciation. This method is particularly useful for new constructions or unique properties where comparable sales data may be limited. By considering the costs associated with land acquisition, construction, and improvements, investors can gain insights into the intrinsic value of a property. This approach encourages a deeper understanding of the factors that contribute to a property’s worth, inspiring investors to think critically about their investments.

As you explore these various valuation methods, it is essential to recognize that no single approach is universally applicable. Each method has its strengths and weaknesses, and the best strategy often involves a combination of techniques. By integrating insights from the CMA, income approach, and cost approach, investors can develop a comprehensive understanding of a property’s value. This multifaceted perspective not only enhances decision-making but also empowers investors to navigate the complexities of the real estate market with confidence.

Ultimately, the process of evaluating properties for your investment portfolio is an ongoing journey of learning and adaptation. As market conditions change and new opportunities arise, staying informed about different valuation methods will enable you to make sound investment choices. Embracing this knowledge can inspire you to take calculated risks and seize opportunities that align with your financial aspirations. By honing your property valuation skills, you are not just assessing numbers; you are building a foundation for a prosperous future in real estate investment.

Assessing Location and Neighborhood

When it comes to evaluating properties for your investment portfolio, one of the most critical factors to consider is the location and neighborhood. The adage “location, location, location” holds true for a reason; the right location can significantly enhance the value of your investment and ensure a steady stream of rental income. To begin with, understanding the dynamics of a neighborhood is essential. Factors such as proximity to schools, public transportation, shopping centers, and recreational facilities can greatly influence a property’s desirability. For instance, families often seek homes near reputable schools, while young professionals may prioritize access to public transit and vibrant nightlife. Therefore, conducting thorough research on the amenities available in the area can provide valuable insights into the potential demand for rental properties.

Moreover, it is crucial to assess the overall safety and security of the neighborhood. Crime rates can have a profound impact on property values and the willingness of tenants to reside in a particular area. By reviewing local crime statistics and speaking with residents, you can gain a clearer picture of the neighborhood’s safety. Additionally, consider the presence of community organizations and neighborhood watch programs, as these can indicate a proactive approach to maintaining safety and fostering a sense of community. A safe and welcoming environment not only attracts tenants but also contributes to long-term property appreciation.

As you delve deeper into evaluating a location, it is also important to consider the economic landscape of the area. Look for signs of growth, such as new businesses opening, infrastructure improvements, and population increases. A thriving local economy often correlates with higher demand for housing, which can lead to increased rental rates and property values. Conversely, areas experiencing economic decline may struggle to attract tenants, resulting in lower returns on your investment. Therefore, keeping an eye on local employment rates and major employers in the vicinity can provide a clearer understanding of the economic health of the neighborhood.

In addition to these factors, it is wise to analyze the future development plans for the area. Local government websites and planning departments often provide information on upcoming projects, such as new schools, parks, or commercial developments. These initiatives can enhance the attractiveness of a neighborhood and lead to increased property values over time. By investing in an area poised for growth, you position yourself to benefit from rising demand and appreciation.

Furthermore, engaging with the community can offer invaluable insights into the neighborhood’s character and potential. Attending local events, visiting nearby businesses, and interacting with residents can help you gauge the overall vibe of the area. A strong sense of community often translates into a desirable living environment, which can be a significant draw for potential tenants.

Ultimately, evaluating properties for your investment portfolio requires a comprehensive understanding of location and neighborhood dynamics. By considering factors such as amenities, safety, economic conditions, and future developments, you can make informed decisions that align with your investment goals. As you embark on this journey, remember that the right location not only enhances your investment’s potential but also contributes to the overall quality of life for those who call it home. With careful assessment and a keen eye for opportunity, you can build a robust portfolio that stands the test of time.

Understanding Rental Income Potential

When considering the addition of properties to your investment portfolio, understanding rental income potential is a crucial step that can significantly influence your financial success. The allure of real estate often lies in its ability to generate consistent cash flow, but realizing this potential requires a thorough evaluation of various factors. To begin with, it is essential to analyze the local rental market. This involves researching comparable properties in the area, often referred to as “comps,” to determine the average rental rates. By examining these figures, you can gain insight into what tenants are willing to pay and how your property might fit into the existing market landscape.

Moreover, it is important to consider the location of the property. Properties situated in desirable neighborhoods typically command higher rents and attract a more stable tenant base. Factors such as proximity to schools, public transportation, shopping centers, and recreational facilities can significantly enhance a property’s appeal. Therefore, investing time in understanding the demographics and economic conditions of the area can provide valuable context for your rental income projections. As you delve deeper into the specifics, you may also want to assess the historical rental trends in the region. Analyzing past performance can help you identify patterns that may indicate future growth or decline, allowing you to make informed decisions about your investment.

In addition to location and market trends, evaluating the property itself is equally important. The condition of the property, its size, and the amenities it offers can all impact its rental income potential. Properties that are well-maintained and equipped with modern features tend to attract higher rents and reduce vacancy rates. Therefore, conducting a thorough inspection and considering any necessary renovations or upgrades can be a wise investment in maximizing your rental income. Furthermore, understanding the costs associated with property management is essential. Whether you choose to manage the property yourself or hire a management company, these expenses will affect your overall profitability. It is crucial to factor in maintenance costs, property taxes, insurance, and any potential homeowner association fees when calculating your expected rental income.

As you compile this information, creating a detailed financial projection can help clarify your investment’s viability. This projection should include not only your anticipated rental income but also your expenses, allowing you to calculate your net operating income (NOI). A positive NOI indicates that the property has the potential to generate profit, while a negative NOI may signal the need for further evaluation or negotiation on the purchase price. Additionally, considering the potential for appreciation in property value over time can enhance your investment strategy. While rental income provides immediate cash flow, the long-term growth of your property can significantly contribute to your overall wealth.

Ultimately, understanding rental income potential is about more than just numbers; it is about envisioning the lifestyle and financial freedom that successful real estate investing can provide. By taking the time to thoroughly evaluate properties and their rental income potential, you are not only making informed decisions but also setting the stage for a prosperous investment journey. With diligence and a keen eye for opportunity, you can build a robust portfolio that not only meets your financial goals but also enriches your life in ways you may not have imagined.

Evaluating Property Condition and Repairs

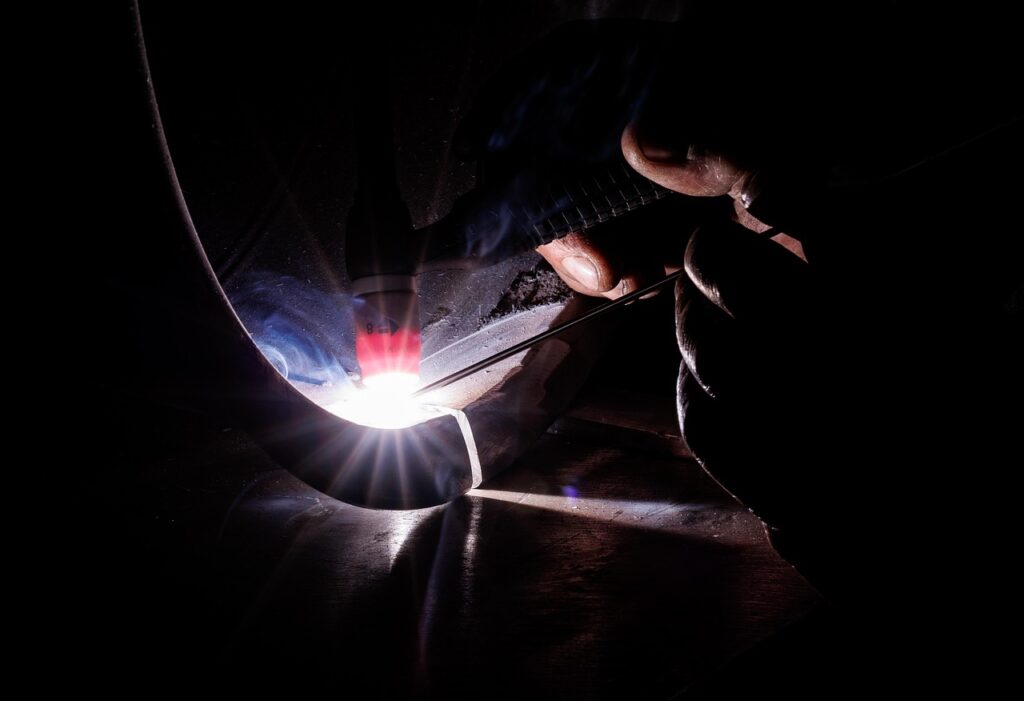

When it comes to building a successful investment portfolio, evaluating the condition of properties is a crucial step that can significantly influence your financial outcomes. Understanding the state of a property not only helps you determine its current value but also allows you to foresee potential costs associated with repairs and renovations. This process begins with a thorough inspection, where you should pay close attention to both the visible and hidden aspects of the property. For instance, while fresh paint and new flooring may catch your eye, it’s essential to look beyond the surface. Inspecting the roof, plumbing, electrical systems, and foundation can reveal underlying issues that could lead to substantial expenses down the line.

As you assess the property, consider enlisting the help of professionals, such as home inspectors or contractors, who can provide expert insights into the condition of various components. Their experience can be invaluable, as they can identify problems that may not be immediately apparent to the untrained eye. Moreover, obtaining multiple opinions can help you gauge the severity of any issues and the estimated costs for repairs. This information is vital, as it allows you to make informed decisions about whether to proceed with the investment or negotiate a lower purchase price based on the necessary repairs.

In addition to physical inspections, it’s also important to evaluate the property’s maintenance history. A well-maintained property often indicates responsible ownership and can suggest that major systems have been regularly updated or replaced. Conversely, a property with a history of neglect may require more extensive repairs, which can eat into your potential profits. Therefore, reviewing maintenance records, if available, can provide insight into how the property has been cared for over the years.

Furthermore, understanding the local market conditions can also play a significant role in your evaluation. Properties in areas with high demand may justify higher repair costs, as the potential for appreciation can offset these expenses. Conversely, in a declining market, investing in a property that requires significant repairs may not yield the desired returns. Thus, aligning your evaluation of property condition with market trends is essential for making sound investment decisions.

Once you have a clear picture of the property’s condition, it’s time to consider the potential for value addition through renovations. Identifying areas where you can enhance the property’s appeal—such as updating kitchens and bathrooms, improving curb appeal, or adding energy-efficient features—can significantly increase its market value. However, it’s crucial to conduct a cost-benefit analysis to ensure that the investment in repairs and upgrades aligns with your overall financial goals.

Ultimately, evaluating property condition and repairs is not just about identifying problems; it’s about envisioning the potential of the property. By taking a comprehensive approach to your evaluation, you can uncover opportunities that others may overlook. This process requires diligence, patience, and a willingness to dig deeper, but the rewards can be substantial. As you build your investment portfolio, remember that each property has a story to tell, and by understanding its condition, you can write a successful chapter in your investment journey. Embrace the challenge of evaluating properties, and let your insights guide you toward making informed decisions that will pave the way for future success.

Analyzing Comparable Sales

When it comes to building a successful investment portfolio, one of the most critical steps is analyzing comparable sales, often referred to as “comps.” This process involves examining properties similar to the one you are considering, allowing you to gauge its market value and potential return on investment. By understanding the nuances of comparable sales, you can make informed decisions that will enhance your portfolio’s performance and ultimately lead to financial success.

To begin with, identifying the right properties to compare is essential. Look for homes or commercial spaces that share similar characteristics with your target property, such as location, size, age, and condition. The more closely aligned the properties are, the more accurate your analysis will be. For instance, if you are considering a three-bedroom house in a suburban neighborhood, it would be prudent to compare it with other three-bedroom homes in the same area that have sold recently. This localized approach not only provides a clearer picture of the market but also helps you understand the demand and pricing trends specific to that neighborhood.

Once you have gathered a list of comparable properties, the next step is to analyze their sale prices. This involves looking at the final sale prices and understanding the factors that influenced those prices. Were there any renovations or upgrades that significantly increased the value? Did the property sell quickly, indicating high demand? By delving into these details, you can gain insights into what buyers are willing to pay and how your potential investment might fare in the current market. Additionally, consider the time on the market for each comparable property; a home that sold quickly may indicate a hot market, while one that lingered could suggest potential issues or overpricing.

Moreover, it is crucial to adjust your analysis based on the unique features of each property. For example, if one of the comps has a newly renovated kitchen while your target property does not, you may need to adjust the price downward to account for that difference. Similarly, if your property has a larger lot size or a better view, you might justify a higher valuation. These adjustments help create a more accurate picture of your property’s worth and can guide your negotiation strategy when it comes time to make an offer.

In addition to sale prices, consider the broader market trends that could impact property values. Are there upcoming developments in the area that could enhance property values, such as new schools, parks, or commercial centers? Conversely, are there any potential drawbacks, such as increased crime rates or declining local businesses? By keeping an eye on these external factors, you can better anticipate how the market may shift in the future, allowing you to make proactive decisions for your investment portfolio.

Ultimately, analyzing comparable sales is not just about crunching numbers; it is about understanding the market landscape and positioning yourself for success. By taking the time to thoroughly evaluate comparable properties, you empower yourself with the knowledge needed to make sound investment choices. This analytical approach not only enhances your confidence as an investor but also inspires a sense of purpose in your journey toward building a robust and rewarding investment portfolio. As you continue to refine your skills in property evaluation, remember that each analysis brings you one step closer to achieving your financial goals and realizing your dreams.

Financial Metrics for Investment Properties

When it comes to building a successful investment portfolio, understanding the financial metrics for investment properties is crucial. These metrics serve as the foundation for making informed decisions, allowing investors to assess the potential profitability and risks associated with various properties. By mastering these financial indicators, you can navigate the complex landscape of real estate investment with confidence and clarity.

One of the most fundamental metrics to consider is the capitalization rate, or cap rate. This figure provides a snapshot of a property’s potential return on investment by comparing its net operating income to its current market value. To calculate the cap rate, simply divide the net operating income by the property’s purchase price. A higher cap rate typically indicates a more attractive investment, as it suggests a greater return relative to the property’s cost. However, it’s essential to contextualize this figure within the local market conditions, as cap rates can vary significantly across different regions and property types.

In addition to the cap rate, cash flow is another vital metric that investors should prioritize. Cash flow represents the net income generated by a property after all expenses, including mortgage payments, property management fees, and maintenance costs, have been deducted. Positive cash flow is essential for sustaining an investment, as it not only covers ongoing expenses but also provides a buffer for unforeseen costs. By focusing on properties that generate consistent positive cash flow, investors can ensure that their portfolios remain resilient and capable of weathering economic fluctuations.

Moreover, the internal rate of return (IRR) is a powerful tool for evaluating the long-term profitability of an investment property. The IRR represents the annualized rate of return that an investor can expect to earn over the life of the investment, taking into account both cash inflows and outflows. By comparing the IRR of different properties, investors can identify which opportunities align best with their financial goals and risk tolerance. A higher IRR indicates a more lucrative investment, making it a critical metric for those looking to maximize their returns.

Another important financial metric is the debt service coverage ratio (DSCR), which measures a property’s ability to cover its debt obligations. To calculate the DSCR, divide the net operating income by the total debt service. A DSCR greater than one indicates that the property generates enough income to cover its debt payments, while a ratio below one signals potential financial strain. Investors should aim for a healthy DSCR, as it not only reflects the property’s financial stability but also enhances its attractiveness to lenders.

As you delve deeper into the world of real estate investment, it’s essential to consider the potential for appreciation. While cash flow and immediate returns are critical, the long-term value of a property can significantly impact your overall investment strategy. By researching market trends, neighborhood developments, and economic indicators, you can identify properties with strong appreciation potential, allowing you to build wealth over time.

In conclusion, evaluating properties for your investment portfolio requires a comprehensive understanding of various financial metrics. By focusing on cap rates, cash flow, IRR, DSCR, and appreciation potential, you can make informed decisions that align with your investment goals. Embracing these metrics not only empowers you to assess the viability of potential investments but also inspires confidence in your ability to build a successful and sustainable real estate portfolio. With diligence and a keen eye for detail, you can unlock the doors to financial freedom through strategic property investments.

Q&A

1. What is the first step in evaluating a property for investment?

Conduct thorough market research to understand the local real estate trends, including property values, rental rates, and economic indicators.

2. What financial metrics should be analyzed?

Key metrics include cash flow, cap rate, return on investment (ROI), and net operating income (NOI).

3. How important is location in property evaluation?

Extremely important; location affects property value, rental demand, and potential for appreciation.

4. What role do property inspections play in the evaluation process?

Property inspections help identify any structural issues, necessary repairs, and overall condition, which can impact investment decisions.

5. Should future development plans in the area be considered?

Yes, potential future developments can influence property values and rental demand, making them crucial for long-term investment strategies.

6. How do you assess the competition in the rental market?

Analyze comparable properties (comps) in the area to evaluate rental prices, occupancy rates, and amenities offered.

7. What is the significance of understanding local laws and regulations?

Local laws and regulations can affect property management, rental practices, and potential returns, making it essential to be informed before investing.

Conclusion

To effectively evaluate properties for your investment portfolio, consider key factors such as location, market trends, property condition, potential rental income, and overall return on investment (ROI). Conduct thorough due diligence, including property inspections and financial analysis, to assess risks and opportunities. Additionally, compare similar properties in the area to gauge competitive pricing and demand. By systematically analyzing these elements, you can make informed decisions that align with your investment goals and enhance your portfolio’s performance.

property valuation methods comparable sales analysis rental income potential market analysis techniques

Images sourced via Pexels.

Leave a Reply